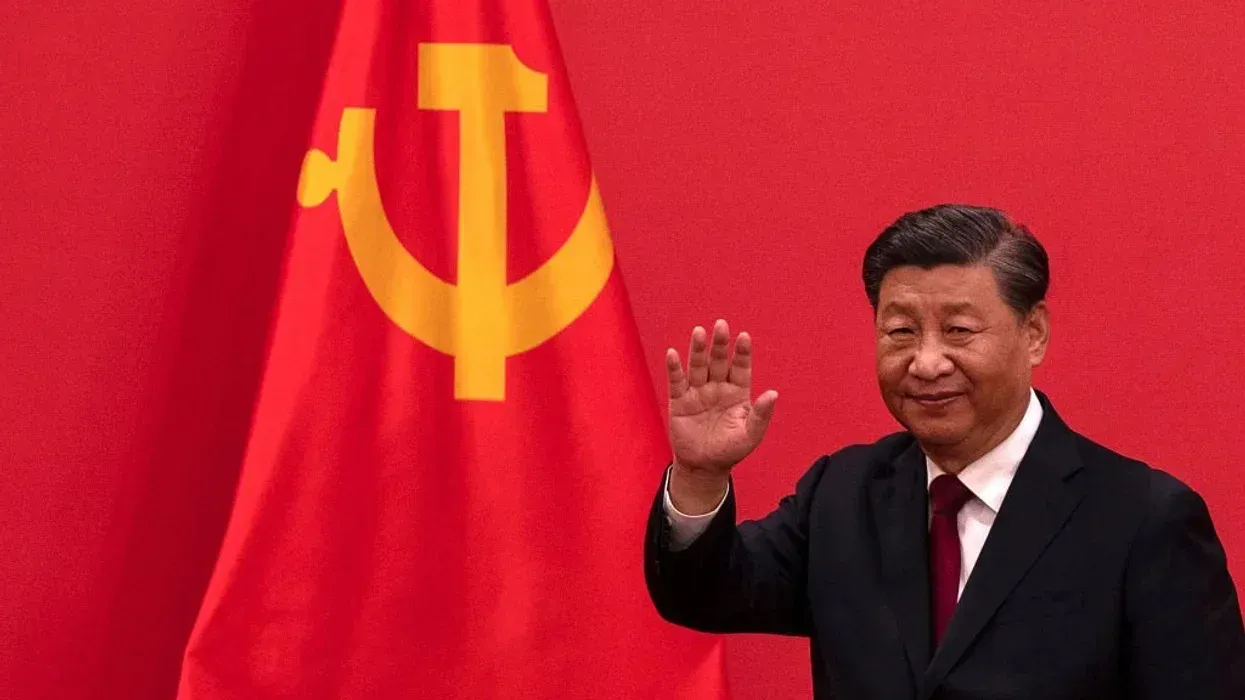

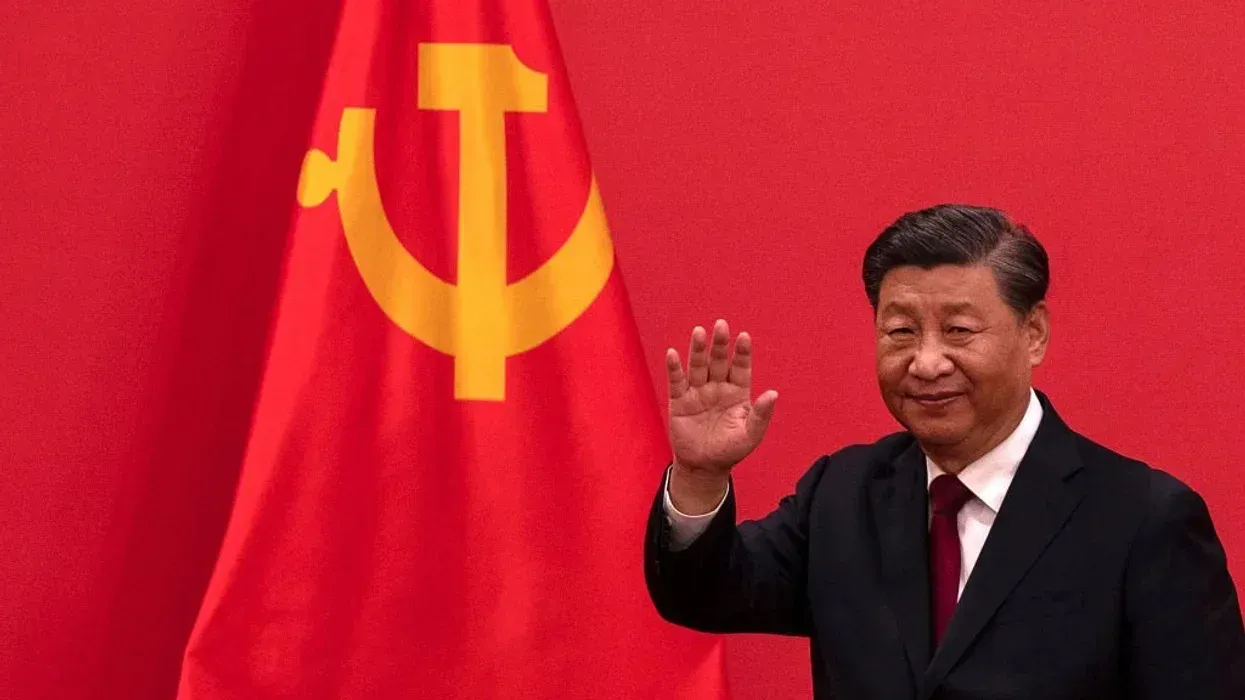

Photo by Kevin Frayer/Getty Images

China, long prophesied to be America's replacement in waiting, might just have to wait forever.

An economic forecast published Tuesday indicated that the second-largest economy will not escape its current slump, but will rather see its growth continue to slow to 3.5% in 2030 and to around 1% by 2050, at which time the U.S. is projected to have 1.5% growth. Previous forecasts put Chinese growth in those years at 4.3% and 1.6%, respectively.

Bloomberg Economics now forecasts that China's gross domestic product will not exceed America's until the 2040s, "and even then, it will happen by 'only a small margin' before 'falling back behind.'"

"China is down-shifting onto a slower growth path sooner than we expected," according to the economists. "The post-Covid rebound has run out of steam, reflecting a deepening property slump and fading confidence in Beijing’s management of the economy. Weak confidence risks becoming entrenched — resulting in an enduring drag on growth potential."

For years, so-called experts amongst the Western intelligentsia have discussed ways America might peacefully abdicate its role as world superpower to communist China, having presumed, along the same lines of Singapore's founder Lee Kuan Yew and other Beijing boosters, that the odds were good the former would soon be eclipsed by the latter.

For instance, the U.K.'s Centre for Economics and Business Research claimed in its December 2020 report that owing to the Chinese regime's "skilful management of the pandemic and the hits to long term growth in the West," China would overtake the U.S. by 2028, five years earlier than previously expected, reported the BBC.

Convinced that the "rise of a 5,000-year-old civilization with 1.3 billion people is not a problem to be fixed," but rather a "chronic condition that will have to be managed over a generation," Graham Allison, former director of the Harvard Kennedy School's Belfer Center for Science and International Affairs," outlined in his popular book "Destined for War" various ways the American ruling power can come to grips with the Chinese displacing power.

As the big brains at CEBR have no doubt become aware, there may be no need to pursue Allison's accommodation strategies as the differing sense that China is a paper dragon might have been right on the money after all.

TheBlaze detailed last month how Beijing was racing to shore up its crashing currency whilst staring down broader economic woes, crashing banks, weakening productivity, geopolitical tensions, and the prospect of multiple failed corporate giants.

Things haven't improved a great deal in the weeks since.

While Country Garden did not similarly go bankrupt Monday as fellow Chinese property developer Evergrande had recently, the resulting optimism was short-lived, reported the Guardian.

"The data has overshadowed relief that the struggling property giant Country Garden has managed to make key interest payments on its debt, reducing, for now, concerns about contagion in the financial sector. China appears to be taking one step forward, but two steps back, as optimism one day turns to pessimism the next," said Susannah Streeter, the head of money and markets at Hargreaves Lansdown.

Despite various stimulus measures intended to whip up consumption demand — such as slashed interest rates on new mortgages — a new industry survey revealed this week that China's services sector plummeted to its lowest level in eight months in August, reported CNN.

Extra to stumbling giants and a weak services sector, two additional factors presently undercutting the aspirations of China's genocidal regime are out-of-control youth unemployment, which skyrocketed to a record 21.3% in June, prompting the National Bureau of Statistics to start concealing subsequent months of more damning figures and a demographic crisis brought about in part by the regime's one-child policy.

"The demographic problem, hard landing of the property sector, heavy local government debt burden, pessimism of the private sector as well as China-U.S. tensions do not allow us to hold an optimistic view towards mid- to long-term growth," Wang Jun, chief economist at Huatai Asset Management, told Reuters.

Desmond Lachman, a senior fellow at the American Enterprise Institute, said, "It is unlikely that the Chinese economy will surpass that of the United States within the next decade or two."

While some analysts have observed parallels between China's slowdown and Japan's, Reuters noted that Japan's GDP per capita "already exceeded the average for high-income economies when it began to stagnate, while China today is around the middle-income point."

William Hurst, a professor of Chinese Development at the University of Cambridge, foresees a bitter end for China, stressing, "Things always fail slowly until they suddenly break."

"There is a significant risk in the short term of financial crisis or other degree of economic crisis that would carry very substantial social and political costs for the Chinese government," Hurst told Reuters. "Eventually there's going to have to be a reckoning."

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!