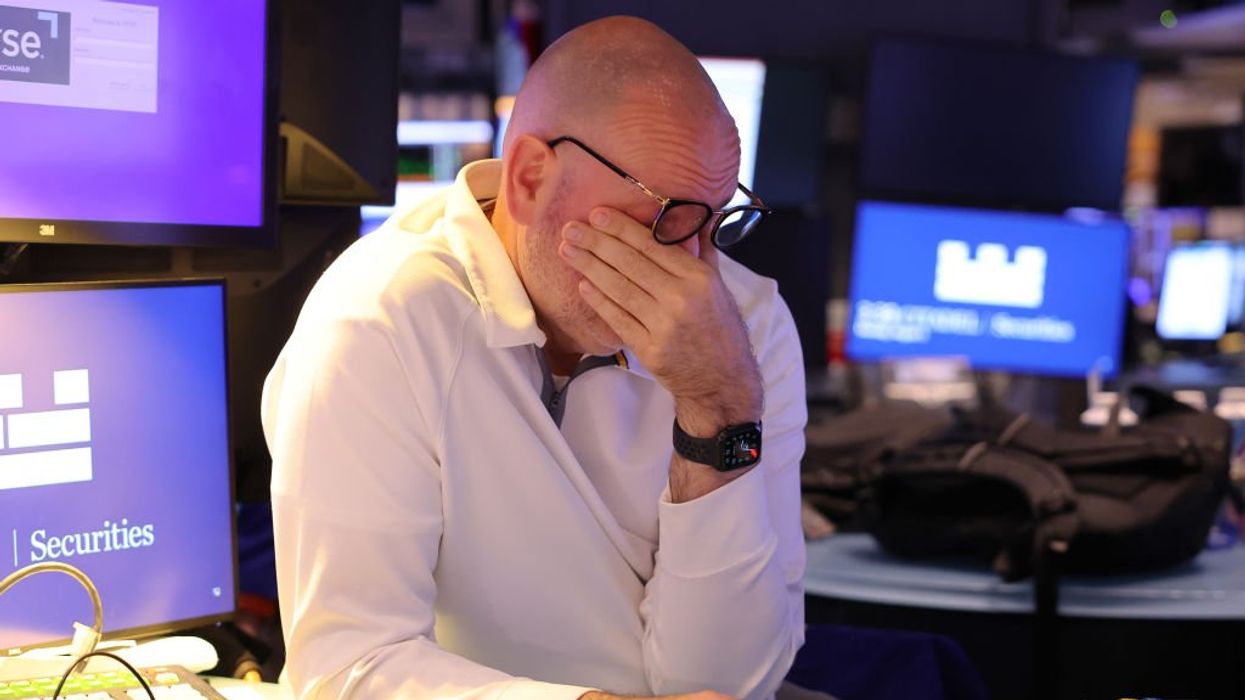

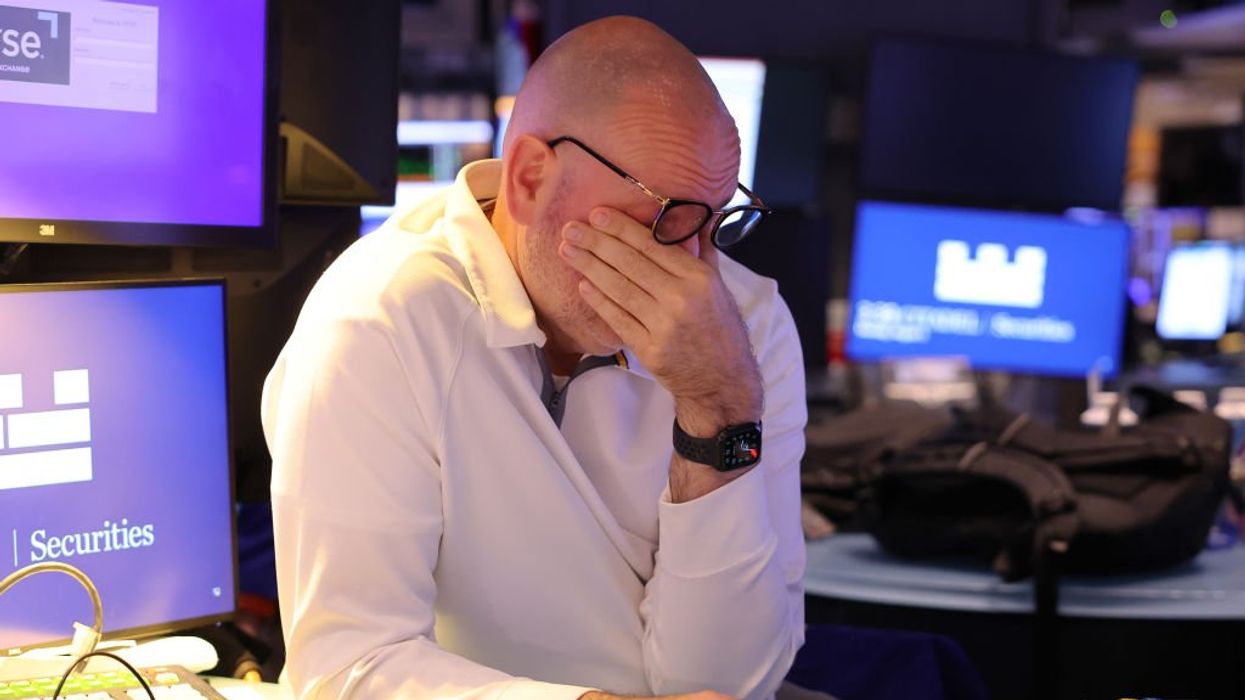

Photo by Michael M. Santiago/Getty Images

Our fiscal foundation has been shaky for a while, and new cracks are beginning to emerge. Get prepared for more financial turbulence ahead.

The investor narrative on the economy has shifted from celebrating stock market highs a few months ago to warning of a recession. A stock market sell-off, a significant drop in bond yields, a weak jobs report, and the triggering of a recession-indicating rule have sent pundits into a tailspin. But what does this all mean for you and your family?

The undercurrents of a recession have been present for quite some time. Following the typical rule of thumb that defines a recession as two consecutive quarters of negative GDP growth, we experienced a technical recession in the first half of 2022. The powers that be declined to officially label it as such, however.

The market has been disconnected from the economy for quite some time, largely due to the Federal Reserve’s nearly 15-year zero interest rate policy disrupting market risks.

Fearing a prolonged or double-dip recession (a short recession, then short recovery, then recession again), the government undertook massive spending to prevent showing no growth. You can call this window dressing.

Normally, in a healthy, organically growing economy, the government would have a smaller deficit because economic growth would drive more revenue to offset spending. However, in recent years, the opposite occurred. The government ran up an enormous deficit — double the historic average as a percentage of GDP — to create the appearance of a healthy, growing economy. This artificial growth came from government and government-adjacent jobs and spending. Consequently, the national debt burden increased, and new debt had to be financed at higher rates than seen in the last decade and a half.

So the growth narrative already had a lot of smoke and mirrors to it as we head into this discussion.

No, the Sahm rule doesn’t refer to stay-at-home moms. Former Federal Reserve economist Claudia Sahm coined the Sahm rule as a recession indicator. It suggests that a recession likely begins when the three-month moving average of the unemployment rate rises 0.5% or more above the lowest three-month moving average in the past 12 months.

In a Bloomberg interview Friday after the jobs report, Claudia Sahm was asked if the Sahm rule was “in force,” to which she replied, “It triggered … yeah.” She added, “That comes off of historical experience. That doesn’t necessarily tell us where we are right at this moment … so whether we are at that moment of a recession or not, this is your build into substantial weakening in the labor market.”

Given the window-dressed economy, as well as the massive disruptions in the market we have seen from nearly 15 years of zero or near-zero interest rate policy — known in the trade as ZIRP — as well as the COVID mandates, benchmarks today are hard to use. Another recession indicator, the inverting of the yield curve (when the yields — how much an investor receives from bonds — on short-term Treasury securities are higher than on long-term Treasuries), happened way back in mid-2022.

In fact, Reuters noted in March, “A key bond market signal of an upcoming recession has flashed red continuously for the longest time ever. … The part of the Treasury yield curve that plots two-year and 10-year yields has been continuously inverted — meaning that short-term bonds yield more than longer ones — since early July 2022. That exceeds a record 624-day inversion in 1978.”

The first reading of this year’s second-quarter GDP was 2.8%. While two more readings will follow before it’s finalized, it’s unlikely to drop to a negative number. Additionally, the U.S. deficit projection for 2024 is $2 trillion, indicating significant government spending to keep GDP positive.

With all of that, we can project softness in the economy, but whether the window dressing keeps growth from going negative remains to be seen.

It is often said that the bond market is where the smart money is and that it’s the indicator to watch (although, as I noted previously, the yield curve has been inverted for a record amount of time).

The yield on the 10-year Treasury, a closely watched indicator for the bond market, went from a high of more than 4.6% over the past three months and more than 4.3% over the past month to close at 3.79% on Friday. CNBC reported that is the lowest level since December 2023.

Remember that bonds and yields move inversely to each other. Tthink of bonds and yields on opposite ends of a seesaw; as bond prices go up, yields go down, and vice versa.

Driven by Fed commentary and the weak jobs report, decreasing yields were interpreted as a signal of coming rate cuts and concerns about the strength of the economy, increasing the recession discussion.

While a weak economy does not help Americans, there are some benefits as yields decrease across the yield curve.

Mortgage rates dropped to levels not seen in over a year (6.4% on a 30-year fixed mortgage). Still quite high and with a tight supply of high-priced housing, this may not be enough to shift the housing market dynamics but is still a welcome shift — if it stays, which, given the Fed signaling, is a good possibility.

Other floating rate debt and other newly issued debt typically see cheaper financing costs as yields decrease.

Gold has performed well in this economic backdrop for several reasons. One reason is the reduced trade-off when bond yields retreat. Unlike bonds, gold doesn't provide cash flow or interest, making it more attractive when bond yields are low.

Feeding off the bond market signals, the jobs report, and some weaker earnings reports, as well as struggles in pricing the highly valued “Magnificent 7” technology stocks, the stock market has lost trillions in market value over the past several weeks, accelerating with more losses on Friday and the Nasdaq going into correction territory — that is, reaching more than a 10% decrease from its high.

Added on to that contagion from the Japanese stock market’s massive sell-off — the second worst day since 1987! — and the markets had a rough day to start the week. The Nikkei rebounded Tuesday.

While each of the indices opened down several percent, the rout in U.S. markets was nowhere near what Japan experienced.

The indices have been on a tear over the last 12 months and were due for a breather, and the potpourri of not-so-great news has been a catalyst. Still, the Nasdaq is up around 29% over the last 52 weeks, and the S&P 500 is up around 26%, so no need to panic quite yet.

The market has been disconnected from the economy for quite some time, largely due to the Federal Reserve’s nearly 15-year zero interest rate policy disrupting market risks. While this might be the least relevant signal, economic weakness will impact companies in the market and individuals’ 401(k)s, which is one of the few silver linings as Americans face rising living costs.

The Fed is likely to become very accommodating again, not only because of its inclination to support Wall Street but also due to the need to monetize the giant deficits and refinance shorter-duration debt in our $35 trillion and growing debt pile.

This is a lot to take in, but I would say that our fiscal foundation has been shaky for a while, and new cracks are beginning to emerge over time. Whether that means official recession or very low growth, get prepared for more financial turbulence ahead, while perhaps having a small amount of time to take advantage of a decrease in interest rates.

Carol Roth

Contributor